“Run for your lives. Run for your lives. The IRS is coming.”

How do you say it, that is bullshit!

After decades of neglect, the Internal Revenue Service is finally getting some new computers and newly trained personnel. You tried to talk to an agent and failed last time. You submitted your tax return and waited months for a refund. Why was that? Because no political party wanted to take responsibility for bringing the IRS into modern times. The “Inflation Reduction Act” of August 2022 finally provided funding so more agents can answer the phone and process your tax return. Modern computers and networks are being established to automatically handle electronic returns.

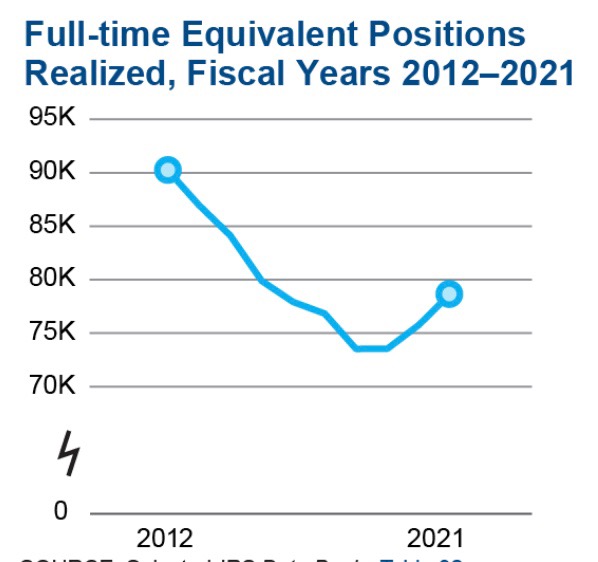

See below how many were employed by the IRS

The IRS collects 96% of America’s revenue to fund all federal programs. If you want a government, you need the IRS. If you want to stop the wealthy using questionable procedures, you need the IRS. Of course, if you are committing fraud, maybe you don’t like a fair system. The law mandates that you keep ALL records used for your latest tax return and at least for 3 previous years.

During Fiscal Year 2021, the IRS collected more than $4.1 trillion in gross taxes, processed more than 261 million tax returns and issued more than $1.1 trillion in tax refunds (including $585.7 billion in Economic Impact Payments and Advance Child Tax Credits).

Random selection and computer screening – sometimes returns are selected based solely on a statistical formula. They compare your tax return against “norms” for similar returns and develop these “norms” from audits of a statistically valid random sample of returns, as part of the National Research Program the IRS conducts. The IRS uses this program to update return selection information.”

Yes, but Republicans claim that the IRS will target middle class families.

What is the purpose of the IRS, to collect money! If you work for the IRS would you target someone making $100,000/year or someone making over $5,000,000/year?

Let’s do the math and saying an auditor makes $48,000/year that’s $4,000/month that’s $1,000/week that’s $200/day, that’s $100 for 4 total hours of work. Assuming that some returns are in 2% error, but not criminally liable. Do you focus on the $100,000 tax return to get $2,000 or the $5,000,000 one and get $100,000? And these individual tax errors are not the real problem.

How many charitable and nonprofit organizations are actually political fund raisers called “Political Action Committees, PACs”? Much of the dark money polluting our system come from PACs and even worse are the super-PACs that can spend unlimited amounts of money supporting candidates and parties. Foreign contributors can provide the dark money to invest in a candidate and an American would never know about this foreign influence.

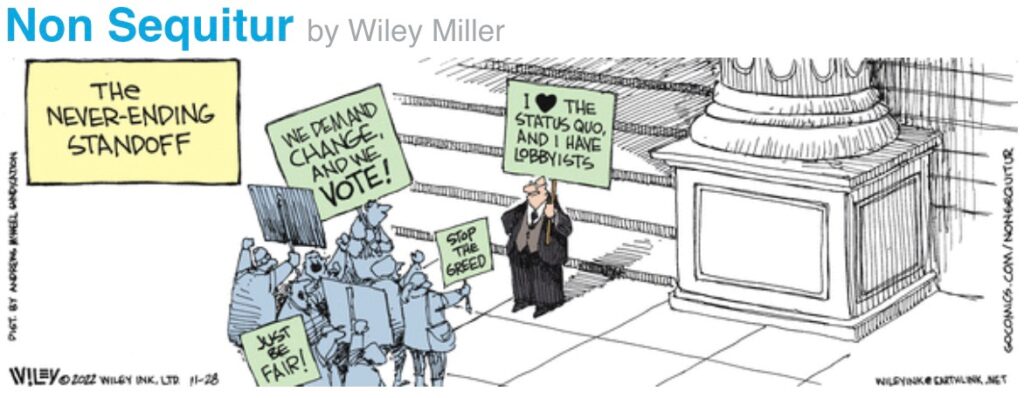

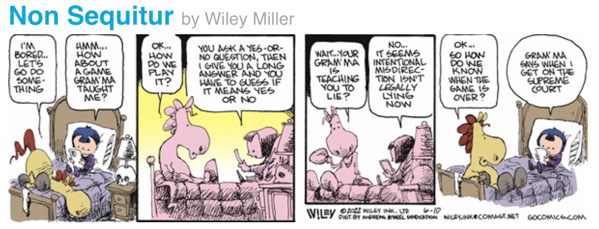

The Supreme Court allowed super-PACs to bribe any politician with campaign contributions from undisclosed sources. If you were running for a state or federal office would you accept $1,000,000 in free ads and free campaign workers?

Dark money’s effect on our democracy

January 21, 2020 will mark a decade since the Supreme Court’s ruling in Citizens United v. Federal Election Commission, a controversial decision that reversed century-old campaign finance restrictions and enabled corporations and other outside groups to spend unlimited funds on elections.

While wealthy donors, corporations, and special interest groups have long had an outsized influence in elections, that sway has dramatically expanded since the Citizens United decision, with negative repercussions for American democracy and the fight against political corruption.

Citizens United decision explained

To reduce the corruption of our political system the voters and states can require states to over match small donations. If someone contributes $50 the state would match that donation times 5 so the donation becomes $300. This rule would encourage candidates to attract many small donors rather than a few big givers.

The current Supreme Court believes that corporations are people. For over 100 years we knew that was not true, but Justice Roberts over turned that policy violating his promise not to overturn long standing Supreme Court rulings.

If you are cheating on your tax returns, then fear the IRS. If your are the normal tax payer then welcome the new improved IRS that will collect additional billions from the wealthy cheats and superPACS that are corrupting our political system. It might even be possible that the federal government would need less of your money. It’s not likely, but possible.